Understanding customer behaviour and effectively segmenting your audience in the highly competitive business landscape is crucial for success. One powerful tool for achieving this is RFM analysis. This method leverages existing customer data to categorise customers based on purchasing behaviour, providing valuable insights that can enhance marketing strategies, customer retention, and overall business performance.

What is RFM?

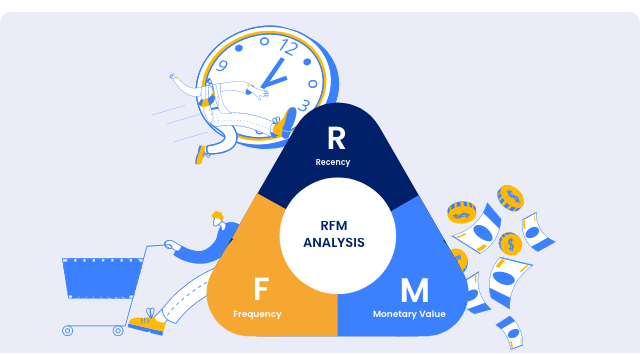

RFM stands for Recency, Frequency, and Monetary Value, a widely used strategy for segmenting customers based on their transactional behaviour. This technique evaluates how recently a customer made a purchase (Recency), how often they make purchases (Frequency), and how much they spend (Monetary value). Businesses can comprehensively understand customer engagement and loyalty by analysing these three dimensions.

While large enterprises commonly utilise RFM analysis, small and medium-sized enterprises (SMEs) often overlook it. However, the benefits of RFM analysis are just as applicable to SMEs and can significantly impact their business success.

Why is RFM Important?

Customer Understanding

RFM analysis provides a deep understanding of customer behaviour and engagement. By examining the recency of purchases, frequency of transactions, and monetary value spent, businesses can gain insights into individual customers' preferences, interests, and loyalty. This information is crucial for tailoring marketing strategies and improving customer experiences.

Segmentation and Personalisation

RFM segmentation divides customers into distinct groups based on their transaction behaviour. This allows businesses to tailor marketing messages, promotions, and offers to each segment, increasing the relevance and effectiveness of their campaigns. Personalised marketing is more likely to resonate with customers, driving higher engagement and conversion rates.

Customer Lifecycle Management

RFM helps map out the customer lifecycle, enabling businesses to identify new customers, loyal repeat customers, and customers at risk of churn. This information informs targeted acquisition, retention, and re-engagement strategies, ultimately improving the customer journey and fostering long-term loyalty.

Retention and Churn Reduction

RFM analysis identifies customers who have not made purchases or are spending less. This insight allows businesses to implement retention strategies to re-engage these customers before they churn. Special offers, loyalty rewards, or personalised recommendations can help retain their interest and loyalty.

Maximising ROI

Businesses can allocate marketing budgets more effectively by focusing resources on high-value segments identified through RFM analysis. Targeted campaigns directed at customers with a history of engagement and higher spending are more likely to generate a positive return on investment (ROI).

Cross-Selling and Upselling

RFM analysis can uncover cross-selling and upselling opportunities. Customers who exhibit high frequency and spending might be interested in premium products or complementary offerings, presenting opportunities to increase their average transaction value and overall revenue.

Data-Driven Decision Making

RFM analysis is rooted in data and metrics, providing an objective basis for decision-making. It allows businesses to move beyond assumptions and gut feelings, making strategic choices based on customer behaviour and transaction data.

Customer-Centric Approach

RFM analysis encourages businesses to adopt a customer-centric approach. Companies can build stronger relationships, enhance customer loyalty, and create more meaningful engagements by understanding and catering to individual customer preferences and needs.

Which Industries Does RFM Apply To?

RFM analysis is versatile and can be applied across various industries to drive business success:

Retail

Retailers often use RFM segmentation to identify their most valuable customers, understand purchase patterns, and design targeted marketing campaigns that enhance customer engagement and drive sales.

E-commerce

E-commerce businesses use RFM analysis to segment their customers and personalise product recommendations, promotional offers, and email marketing based on individual shopping behaviour, increasing the likelihood of repeat purchases.

Finance and Banking

Financial institutions leverage RFM segmentation to categorise customers based on their transaction history, optimise cross-selling and upselling opportunities, and tailor financial services to different customer segments.

Hospitality and Travel

The hospitality and travel industry companies analyse customer spending patterns, booking frequency, and stay history to enhance guest experiences, loyalty programs, and targeted offers.

Telecommunications

Telecommunication companies use RFM segmentation to understand usage patterns, offer personalised plans and promotions, and improve customer retention strategies.

Subscription Services

Businesses offering subscription models, such as streaming services and subscription boxes, use RFM segmentation to identify and engage high-value subscribers, reducing churn rates and increasing customer lifetime value.

Automotive

Automotive companies analyse customer behaviour and purchase history to design targeted marketing campaigns, offer personalised deals, and enhance customer retention efforts.

Healthcare

Healthcare providers can use RFM segmentation to categorise patients based on appointment frequency, medical history, and engagement with healthcare services, improving patient care and engagement.

B2B Services

Even in the B2B sector, RFM segmentation can be applied to identify critical clients, understand purchasing habits, and optimise communication and relationship-building strategies.

Nonprofit Organisations

Nonprofits use RFM segmentation to categorise donors based on their giving frequency and donation amounts. This allows for more personalised fundraising strategies and improves donor retention.

Manufacturing

Manufacturing companies can utilise RFM analysis to refine customer engagement and operations. Companies can categorise customers by assessing recent purchases, buying frequency, and transaction amounts, enabling customised marketing, personalised communication, and targeted promotions. Valuable customers can be identified for special offers, dormant ones can be re-engaged, and inventory management can be optimised.

Conclusion

RFM analysis is a powerful tool that can drive business success by providing deep insights into customer behaviour and enabling targeted, personalised marketing strategies. By leveraging RFM analysis, businesses can enhance customer engagement, improve retention rates, and maximise ROI. Whether in retail, e-commerce, finance, or any other industry, incorporating RFM analysis into your business strategy can help you better understand your customers and create more effective, data-driven marketing campaigns. Embracing this analytical approach will enable you to build stronger customer relationships, foster loyalty, and drive your business towards sustained success.